Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

5-axis CNC machining is a sophisticated method used to produce complex and…

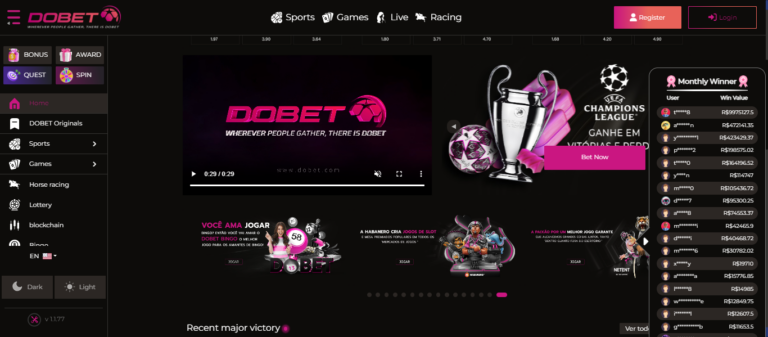

In the realm of online entertainment, DOBET has emerged not just as a betting…

Gaming has become an integral part of modern entertainment, captivating millions of…

Pruning is a critical practice in gardening and agriculture that ensures the…

Welcome to AMBIZ, your one-stop destination for premium pet accessories designed to…

Partner with Cash4WasteOil for top-tier waste oil collection services in London. Ensure…

Ladang78 merupakan salah satu situs terpercaya Indonesia dengan permainan pelajari hasil togel…

Navigating the world of online football betting can be a daunting task.…

Few things are as invigorating and rejuvenating as a hot shower. Yet,…

In the scenic county of Kent, where both the rustic charm of…